How the tax super-deduction can benefit manufacturers investing in new automation equipment

The UK Government has announced a new tax ‘super-deduction’ for companies looking to invest in new machinery. Our finance director, Lizzie Hay, breaks down what the new legislation means for manufacturers and why now is the time to invest in new automation equipment.

On 3 March 2021, Chancellor Rishi Sunak announced new legislation that would encourage companies to invest in new productivity-enhancing machinery within the next two years as a way of boosting the UK recovery from the Covid pandemic.

What is the super-deduction tax reduction?

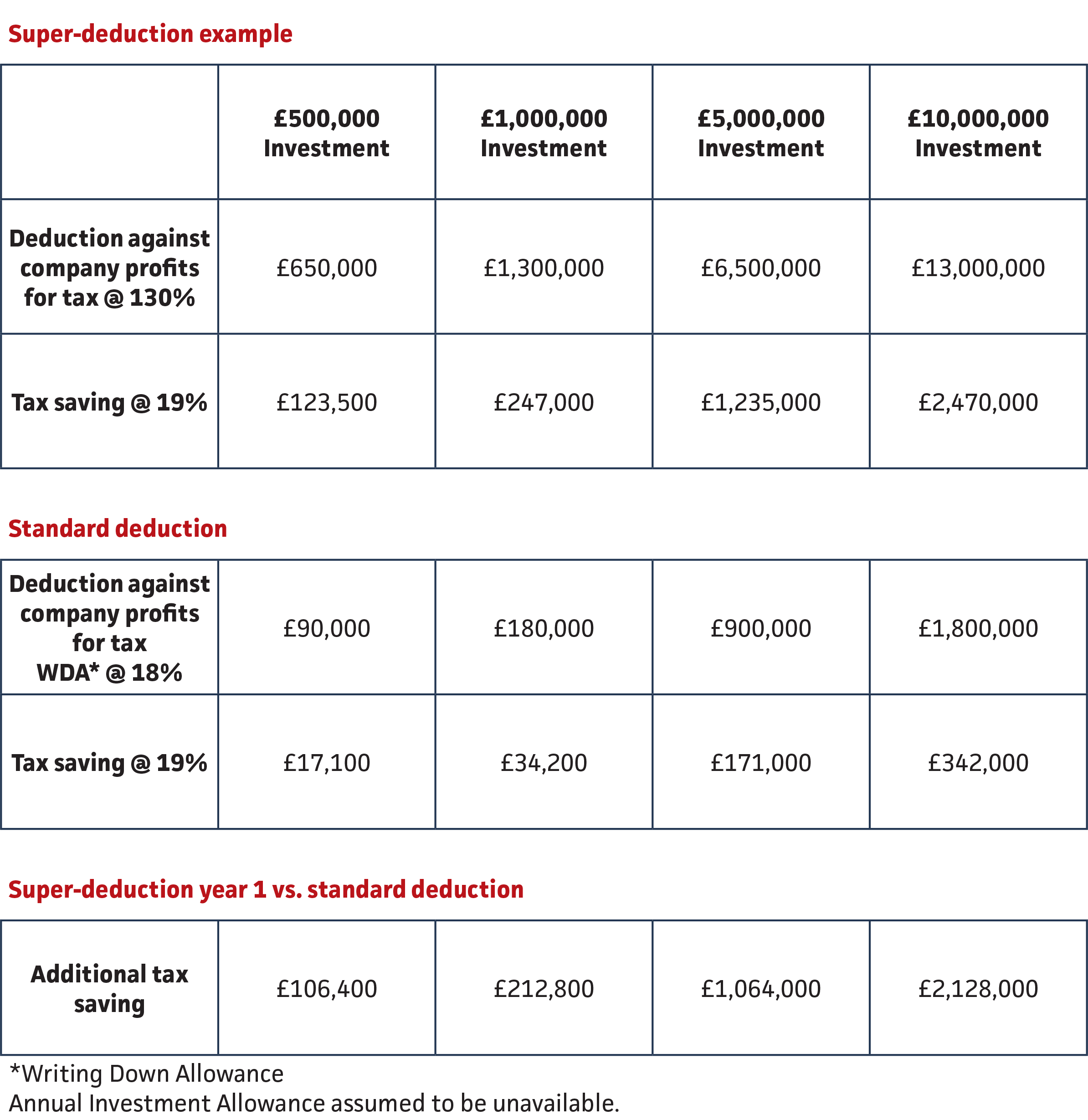

From 1 April 2021 until 31 March 2023, companies can claim new capital allowances on qualifying plant and machinery investments. Under this super-deduction, companies can reduce their tax bill by up to 25p for every pound that is invested.

This means that companies investing in new plant and machinery assets can deduct 130% of the machinery cost from their taxable income.

Example of the super-deduction in action

What machinery is included in the scheme?

Most physical, measurable assets used during a business are considered plant and machinery for the purposes of claiming capital allowances. The asset must be available to use and provide benefit to the company within the two years, even if the payments are made before 31 March 2023.

The scheme also includes investment in upgrading and refurbishing automation equipment. For more information on how Sewtec can upgrade your existing machinery, even if Sewtec was not the original manufacturer, visit our modernisation and upgrades capabilities page.

The scheme will also benefit larger corporations, as well as SMEs, who can claim relief on a variety of investments over the next two years. For manufacturers considering investing in new automation equipment, now is the time to take advantage of the temporary tax benefits.

Eligibility criteria can be found here.

What are the restrictions and limitations?

The tax relief excludes any contracts signed before 3 March 2021, even if expenditures are incurred after 1 April 2021.

Companies will have only two years to benefit from this tax reduction, with the temporary rates expiring on 31 March 2023.

Plant and machinery expenditure which is incurred under a Hire Purchase or similar contract must meet additional conditions to qualify for the super-deduction and special rate relief.

These reliefs are only available for companies within the charge to Corporation Tax. Unincorporated businesses can claim the full cost of expenditure through the Annual Investment Allowance, up to the relevant limit.

For more information, please refer to the UK Government website. Details are correct at the time of writing. Please note, legislation is still being written and companies are advised to seek independent advice on how this legislation can benefit them.